Knowing how to use your money can sometimes be a daunting task. Nevertheless, it is a great way to ensure your financial stability. Keeping money in your bank account will not give you benefits or income in the long run. Therefore, you should consider investing, to maximize your return of the capital. However, it is important to mention that you also need to pay attention to risk optimization.

Table of Contents

Why is necessary to invest money?

img source: theascent.com

This is one of the most common questions. The simple answer is – to increase your capital.

Let’s say you hold your capital in dollars, pounds, or euros … Whatever currency is involved, you must be aware of inflation. That means that the value of the currency will decline over time. In practice, it means that for $ 100, you will be able to buy fewer things over time.

The reason for this is the fact that inflation increases the prices of goods and services. Guided by this fact – it is in your interest to invest your money in financial instruments to grow your capital over time. On the other hand, if you are passive, you are effectively reducing your capital.

There are several investment instruments – stocks, bonds, ETFs, CFDs, and cryptocurrencies. Most of these instruments offer significant earning potential. That is much more than the income you can earn in a savings account. Of course, it is indisputable that every investment carries a certain level of risk. Just as numerous investment opportunities are, so are the reasons for investing.

The reason for investing can be retirement planning, meeting personal financial goals, or maintaining and steady growth in available capital. Certain investment instruments also offer tax breaks. That can give you double benefit – saving taxes and capital gains.

What to invest money in?

img source: investopedia.com

You’re probably wondering where to invest your capital? Investors invest money in various markets and various instruments. We will present several forms of investment to help you make that decision.

Investing in stocks and stock-market funds

img source: economictimes.com

A stock is an instrument that represents a share of ownership of a publicly listed company. Companies issue shares to attract the investments needed for their business. Shares are a means by which you can earn and gain some ownership of a company.

Trading stocks is usually performed on the OTC market’s official exchanges. There are two common methods for making money on stocks. The first is that you buy stocks at a lower price and sell at a higher price. This is called capital gain.

To make money this way, investors invest in stocks of fast-growing companies. The shares of such companies are attractive to day traders and long-term investors.

Another way is to pay dividends. Once you buy the company’s shares, you also qualify for the profits generated by the company itself. In addition to stocks, there are other exchange-traded instruments such as bonds and stock indexes.

Stock indexes are a very popular investment option. Stock indexes capture the effect of a particular group of stocks. According to InvestoTrend, when choosing a broker, you must make sure that it is regulated by the FCA. Traders can buy shares directly, or they can invest through CFDs related to a specific financial instrument such as stocks or indexes.

Investing in ETFs (Exchange Traded Funds)

img source: visualcapitalist.com

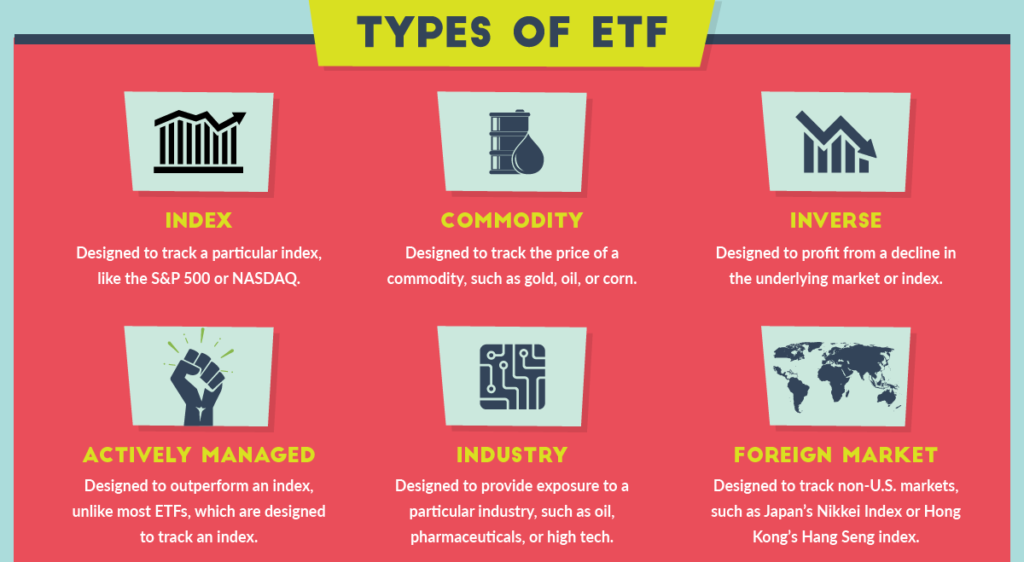

ETFs are one of the better options for investing. An ETF is a set of stocks of a particular industry. ETFs are index-based investments whose performance is based on correlated indexes. The goal is to limit the return on the indexes on which the ETF is based.

To successfully trade ETFs, it is necessary to accurately monitor and predict the impact of a large number of companies, or their shares.

Investing in cryptocurrencies

img source: blog.visor.com

Investing in cryptocurrencies is very exciting. Today, cryptocurrency trading has become mainstream. It is especially after the phenomenal growth of this market in 2017. There is high volatility in the cryptocurrency market.

Therefore, investors are exposed to a large number of opportunities to open and close positions. Bitcoin is still the number one cryptocurrency. Other cryptocurrencies are known as altcoins. As this form of investment is increasingly accepted by the public, the potential for the coming years is increasing.

Bonds and investments

img source: thenypost.files.wordpress.com

So, what are bonds? Companies, governments, and their agencies issue bonds to raise capital. All bonds have a face value, interest rate, and maturity date. The bond is redeemed at face value from the issuer. The issuer periodically pays interest to those who invest in them.

The bond market is also known as the fixed income market. Bonds are debt instruments. The main advantage for investors is that bonds offer fixed-income payments. Many government bonds are tax-exempted. It means that interest income is free of taxes. Therefore, the investor has a double benefit.